Riccardo Altan

International Capital Allocation Advisor | Financial Engineering Expert

Riccardo Altan is a multinational capital consultant, financial engineering researcher, and multi-asset allocation expert with more than thirty years of professional experience. His career spans Milan, London, Zurich, and New York, where he has long served leading asset-management institutions across Europe and North America. He specializes in building resilient and sustainable investment strategies through structured instruments, quantitative models, and cross-border capital pathways.

Known for his rigorous and systematic research methodology, Riccardo is highly regarded for his deep understanding of global market structures and long-term asset allocation. He has served as a trusted long-term advisor to multiple international institutions and family offices.

The Foundation of Quantitative Thinking

-

Bocconi University — BSc in Economics (1986–1990)

-

London School of Economics (LSE) — MSc in Finance (1990–1992)

-

ETH Zurich — PhD in Financial Engineering (1993–1997)

During his doctoral studies, Riccardo focused on asset-pricing mechanisms, risk-factor models, and cross-border capital structures. This research built a strong theoretical foundation for his later work in multi-asset strategies, institutional advisory, and international capital-flow analysis.

Professional Certifications & Global Standing

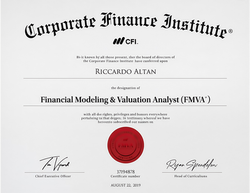

Riccardo holds four international finance certifications: CFA (Chartered Financial Analyst), FRM (Financial Risk Manager), CAIA (Chartered Alternative Investment Analyst), and FMVA (Financial Modeling & Valuation Analyst). Together, these qualifications cover core domains such as asset pricing, risk management, alternative investments, and corporate valuation, enabling him to conduct cross-market research and provide medium- to long-term asset allocation advisory services in the mainstream capital markets of Europe and North America.

-

The CFA program emphasizes global asset allocation, financial engineering, and capital market analysis, giving him strong professional depth within the European and U.S. fund management systems.

-

The FRM program focuses on risk modeling, hedging strategies, and crisis management, providing a rigorous risk framework for multinational institutional investors.

-

The CAIA program covers hedge funds, structured products, private assets, and other non-traditional investment fields, equipping him to design alternative asset structures for clients in Europe and North America.

-

The FMVA program strengthens his capabilities in corporate value analysis, building financial models, and forecasting return structures, forming the foundational skill set for cross-border research and practical model implementation.

His academic work focused on multi-market asset volatility and long-term return structures, forming a rigorous theoretical foundation in quantitative risk management.

A core belief that has guided his career is:

“Investment is not the pursuit of profit, but the structured management of time.”

2004

Chartered Financial Analyst(CFA)

2007

Financial Risk Manager(FRM)

2011

Chartered Alternative Investment Analyst(CAIA)

2019

Financial Modeling & Valuation Analyst(FMVA)

|  |  |

|---|---|---|

|

International Professional Credentials

Riccardo holds four major global financial qualifications:

-

CFA (Chartered Financial Analyst)

-

FRM (Financial Risk Manager)

-

CAIA (Chartered Alternative Investment Analyst)

-

FMVA (Financial Modeling & Valuation Analyst)

These credentials authorize him to provide compliant cross-border advisory services across the U.S., European, and Swiss financial regulatory frameworks, representing top-tier international professional standards.

Advancing Structured Financial Thinking

Riccardo believes that financial education and structured asset-management principles are essential core competencies for the next generation of global investors. He is committed to:

-

Enhancing investor understanding of risk and structure

-

Promoting transparency and systemization in cross-border capital flows

-

Building a long-term, logic-driven culture of asset allocation

As he often says:

“The essence of investing is not predicting the future, but building structures that can withstand uncertainty.”